Moving house is often described as one of the most significant events in one’s life. Understanding the average moving costs can help you plan your budget more effectively. Not only because it is exciting, but because it is stressful as well. Long distance moves particularly can put a great burden on one’s budget, so we tried to develop a moving cost calculator that will provide you with an accurate estimate. You will be able to determine the true cost of your home move, thus balancing your budget and relieving you of the stress and strain associated.

Why Would a Moving Cost Calculator Help You?

When moving house, budgeting the costs involved is one of the harder tasks to complete successfully. The costs are varying, from estate agent fees to the average cost you will have to pay the removal company.

Moving Cost Calculator

The different costs of various services across providers makes things harder to keep track of, and the full price comparison almost impossible. The interactive cost calculator, however, helps you balance out all the difficulties. Our moving fees calculator will:

- Help you save money by doing accurate price comparison

- Get you accurate estimates about moving services

- Consider council tax, energy performance certificate, buildings insurance and other additional expenses that typically remain hidden

- Account for legal fees, land transaction tax, and stamp duty

- Help you add packing supplies, removal firm charges and house removals or man and van for hire into the bill

The Costs Involved in a House Move

There are a couple of categories expenses related to moving into a new house fall into. Understanding the average costs associated with these expenses can help you budget more effectively. The upfront costs are the stamp duty, which depends on the property value and weather or not you are a first time buyer; land transaction tax in Northern Ireland and Wales, capital gains tax if selling an additional property, and of course the conveyancing fees to the conveyancing solicitor who is doing all the legal paperwork.

Selling and Purchase Costs

When you are done with the upfront fees, no matter whether buying or selling a property, you are faced with additional costs such as estate agent fees when listing the house, the commission of the house estate agents based on the property price, and things like the home report and the performance certificate fees. The average UK property comes with its own set of financial implications, including associated costs for moving and calculating deposits. The mortgage provider may also ask for a fee to process your loan application.

Moving Costs

It may very well turn out that the actual cost to move house is the lowest expense involved in the process. It depends, of course, on the distance of the relocation, the removal firm you pick up to help you with the job, and some additional services you may use such as packing. All the major expenses here include:

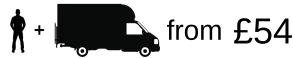

- Hiring a removal company

- Buying boxes, bubble wrap, and other packing supplies

- Moving services for the transportation of bulky and fragile items as part of your house removals

- Paying for building insurance on your new property

- Adjustments on your council tax based on the property price

Reducing the cost of your move

There are a few tip and tricks that you can follow as a strategy of reducing the overall cost of moving. In this way, your move will not be as expensive a business as it may be. To save money by reducing expenses:

- Get full price comparisons from as many removal companies in your area as possible

- Negotiate lower costs for your estate agent fees

- Consider saving from additional moving services such as packing by getting packing supplies and doing the job on your own

- Look for discounts from mortgage providers

- Use our moving house calculator to get more accurate estimates of your costs of moving.

You should also be on the lookout for all factors that may contribute to an increased cost of moving, such as exchange contract fees, interest rates and even missing the chance to get the best price by negotiating a better deal. Costlier properties come with higher house stamp duty on top of the purchase price, so that’s another thing you might want to take into consideration.

In Summary

We know that moving homes, even at a short distance, can be a very expensive business. When you have the right tools at hand, and the ability to calculate the cost of your move accurately, things become much easier though. Our moving cost calculator is here to make your moving process run much smoother. Once you get all fees into consideration, the price comparison and finding the best price for your home move becomes easier.

About the Author:

Prev: « How Long Does It Take To Move House (UK): Full Timeline and StagesNext: The Complete Tutorial to the Change of Address Letter: Template & Tips »