For many people, homeownership is a dream. However, you should consider a few things before you make a long-term housing choice and decide what is more financially savvy – renting or buying. But this is only unless you have a well-funded bank account, of course. If not, you have to think carefully and analyse your current financial situation, as well as your future income and saving plans. Here are things to consider before you decide whether you are ready to buy a home or rent one.

Are you in debt?

Before you consider transiting from renting to owning, you need to be realistic about your debts. If you already have a credit card or loan debts and you give a great part of your monthly income to cover those costs, will you be able to add a mortgage payment on top of that? Or paying a rent that is usually more affordable is a better option for you? Additionally, note that you are not eligible for owning if you have a big debt.

Do you know all the costs?

You can start by comparing rental and mortgage prices. But, you cannot make your decision solely based on this. There are expenses only a homeowner has to take care of, and a renter doesn’t have to deal with, including:

Insurance – as a homeowner, you will want to protect your home against damage. However, this rate is more expensive if you are a homeowner than a renter. Homeowner’s insurance is about three times bigger than that a renter pays.

Maintenance – as a homeowner, you will be faced with regular maintenance and repairs expenses, such as a heating, ventilation and air conditioning repairs, roof repair, etc.

Property taxes – each homeowner has to pay property taxes that vary depending on location, size or community benefits.

Do you have savings on your account?

As a renter, you can be flexible with certain expenses related to your rent, small fixes, emergency situations, and other. If you are experiencing some financial difficulties, you can always leave your rented apartment and find a more affordable one. But, before you do, make sure you get your rental deposit back by hiring a company that will ensure a stress-free end of tenancy cleaning in London.

However, as a homeowner, you only have yourself to rely on in terms of finances. This is why you have to have savings in case of unexpected situations. You have more responsibilities as a homeowner and the bank is not that flexible if you fail to pay your mortgage on time. So, if you have no savings, it is best for you to rent, until you get your financials in order.

Are you a moving addict?

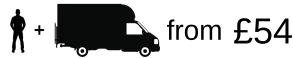

If you are a type of person that cannot stay at one place for a long period of time and have to move often for reasons only known to them, then you should reconsider buying a home and stick to renting. If this is a case, hire a professional and affordable moving company in London to have a stress-free moving experience.

If you are a type of person that cannot stay at one place for a long period of time and have to move often for reasons only known to them, then you should reconsider buying a home and stick to renting. If this is a case, hire a professional and affordable moving company in London to have a stress-free moving experience.

Buying an expensive house or apartment and feel the urge to move again in few years is not something you want for yourself. If you like to experience different living surroundings, renting is a lot more practical and convenient solution for you. You can make any house or apartment a home even if you are renting.

About the Author:

Prev: « Five Reasons to Love LondonNext: 5 Ways to Cope with Moving House Anxiety »